Vaccines and the inverted capital dilemma

Covid has flooded a barren vaccine startup landscape with capital. And that has revealed some valuable lessons for investors, company builders, Congress, and the public.

Innovation thrives in the spotlight

The story of Alexander Fleming is a popular one. As it should be - it’s a good story about one of the most important discoveries in medical history, penicillin. But most people only know the first act of the play.

And now for something completely different

LENZ Therapeutics CEO Eef Schimmelpennink spoke with RApport about how last year’s acquisition of Pfenex by Ligand gave him a chance to seek out a new challenge, the benefits of breaking the mold, and helping 120 million Americans ditch their reading glasses.

Good or just successful? The Belichick conundrum

In biotech - an industry where companies live or die by the success of a lead asset - how much impact does a successful management team have? And more broadly, how should we define success? Is it a matter of stock price? The ability to drive an acquisition? Do your employees even like you as a person?

After binging on COVID-19, what have we missed?

Given the seemingly endless supply of COVID-19-related content, it has sometimes felt like I was passively binging on round-the-clock coverage that was more distracting than edifying. So what might I have missed while I was absorbed in COVID? As it turns out, quite a lot.

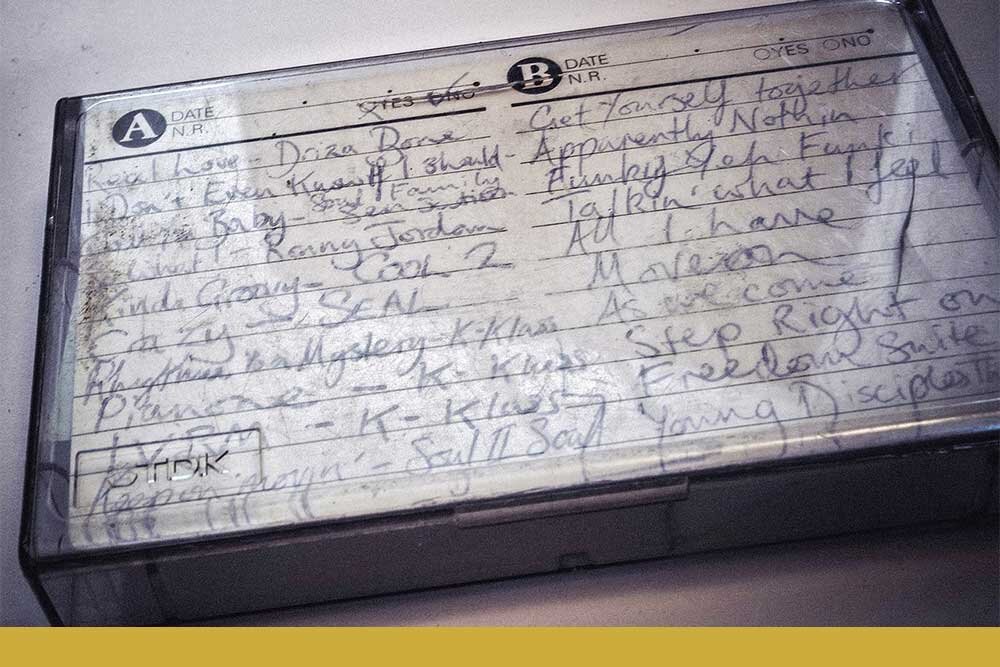

Investors and academics: making beautiful music together

Interest in life science technologies and tools is accelerating with the advent of CRISPR and other aspects of synthetic biology. The ability to have a capital efficient way to advance these innovations is very attractive and will help drive innovation.

Accelerating life science tools R&D with venture studios

Interest in life science technologies and tools is accelerating with the advent of CRISPR and other aspects of synthetic biology. The ability to have a capital efficient way to advance these innovations is very attractive and will help drive innovation.

Four core principles for biotech board meetings

There are many ways to conduct an efficient board meeting, and every management team and board member has different preferences. But here are four key principles I believe will improve everyone’s experience.

How to assassinate your start-up: a legal guide

To be sure, none of these can ensure death with dignity, but most will speed your start-up’s demise – especially when taken as combination therapy.

Venture capital evolved to venture creation. Will it stay that way?

The so-called venture creation model has fully taken root, underpinned and enabled by biotech's longest-ever boom cycle and unprecedented sums of available capital.

Venture partnering

Adam Rosenberg lifts the curtain on what biotech venture partners and entrepreneurs-in-residence really do.

Welcome to RApport

We’re glad you’re here. Read more about the genesis of RApport and our mission and goals.

The difference between medical debt and "moon debt"

The difference between investing in space exploration and investing in the biotech industry is about who bears the cost: society as a whole or people as individuals.

If Trikafta isn’t good enough for ICER, what drug Is?

ICER released a report concluding that Vertex’s groundbreaking triple-combination cystic fibrosis (CF) drug, Trikafta, is too expensive for the value it provides to patients. But is it?

Covid-19 teaches us the real definition of a 'novel drug'

Whatever therapy or intervention solves a previously unmet need is inherently novel. So any treatments for COVID-19 that turn out to work will be "novel" in every way that matters.