How to kill the conversation that makes innovation possible

By RApport

June 23, 2022

As the November 2022 midterms loom, talk of President Biden’s “Build Back Better” plan is bubbling back to the surface. Drug pricing reform is again at the forefront of the conversation, and with inflation at 8.6%, it’s undeniable – Americans are hurting, and paying less at the pharmacy counter may alleviate part of that burden. But not all drug pricing reforms are created equal. In fact, many popular reforms won’t have any impact at all on what patients pay. And if to achieve short-sighted ends we unintentionally crush the research and development we rely on to discover tomorrow’s cures, we as a society will have failed.

So why do economists say that price controls on drugs will stifle R&D? Isn’t that just a pharma talking point? And how can you explain it to someone else in layman’s terms?

Explore RA Capital & No Patient Left Behind’s simple, graphical explanation in our free “How to Kill the Conversation that Makes Innovation Possible” course, part of RA University. (Or, read on for a teaser!)

—

No matter the sector – whether medicine, software, energy, food service, or biotech – innovators have ideas on how to create solutions to problems. But they need funding to pursue those ideas. So they talk to investors.

Investors probe the feasibility of innovators’ proposals. They need a return on their investments, so they need to know that the drug a new biotech company is hoping to develop will really be valued by society. How can the company be sure that patients will want it, physicians will prescribe it, or insurance will cover it? Thousands of these conversations happen every day.

If investors believe that the ultimate reward for success justifies the risks of funding a product’s development, they will invest. Patients will have hope for progress and new medicines. But if investors don’t believe the reward for success will be adequate, they won’t invest, and we won’t know what might have been. That’s the innovation funding marketplace.

Not every project gets funded. Most ideas aren’t worth investing in. And R&D is hard, especially in biotech. Most projects fail before they even get to human trials. Of the ones that get that far, fewer than 8% become FDA-approved medicines.

To know if it’s worth funding a “seed-stage” project, investors work backwards from the reward and through the risks/costs to figure out the project’s present value.

But when the value of eventual success is too low, the math doesn’t work out and investors can’t justify taking on the risk.

A reward for the rare winner is what gives an entire portfolio’s worth of risky projects the overall positive return that makes the portfolio investable.

But price controls – or even the real possibility of price controls – kill that conversation. When investors have no certainty about how a product will be valued, every idea becomes uninvestable. And in a market like the one we see today, it’s easier than ever to make the decision not to invest.

The value of a successful drug today may seem high, but its development risks are high, too. And cutting the expected future price of a drug could reduce its value to the point where the seed of its invention just isn’t worth planting.

With price controls for new drugs on the table, investors will redeem their money from biotech and look for a return in other sectors – maybe social media, video games, or energy. Biotech innovators will struggle to get projects funded, and many won’t be funded at all. As a society, we might get another Netflix instead of a cure for Alzheimer’s disease.

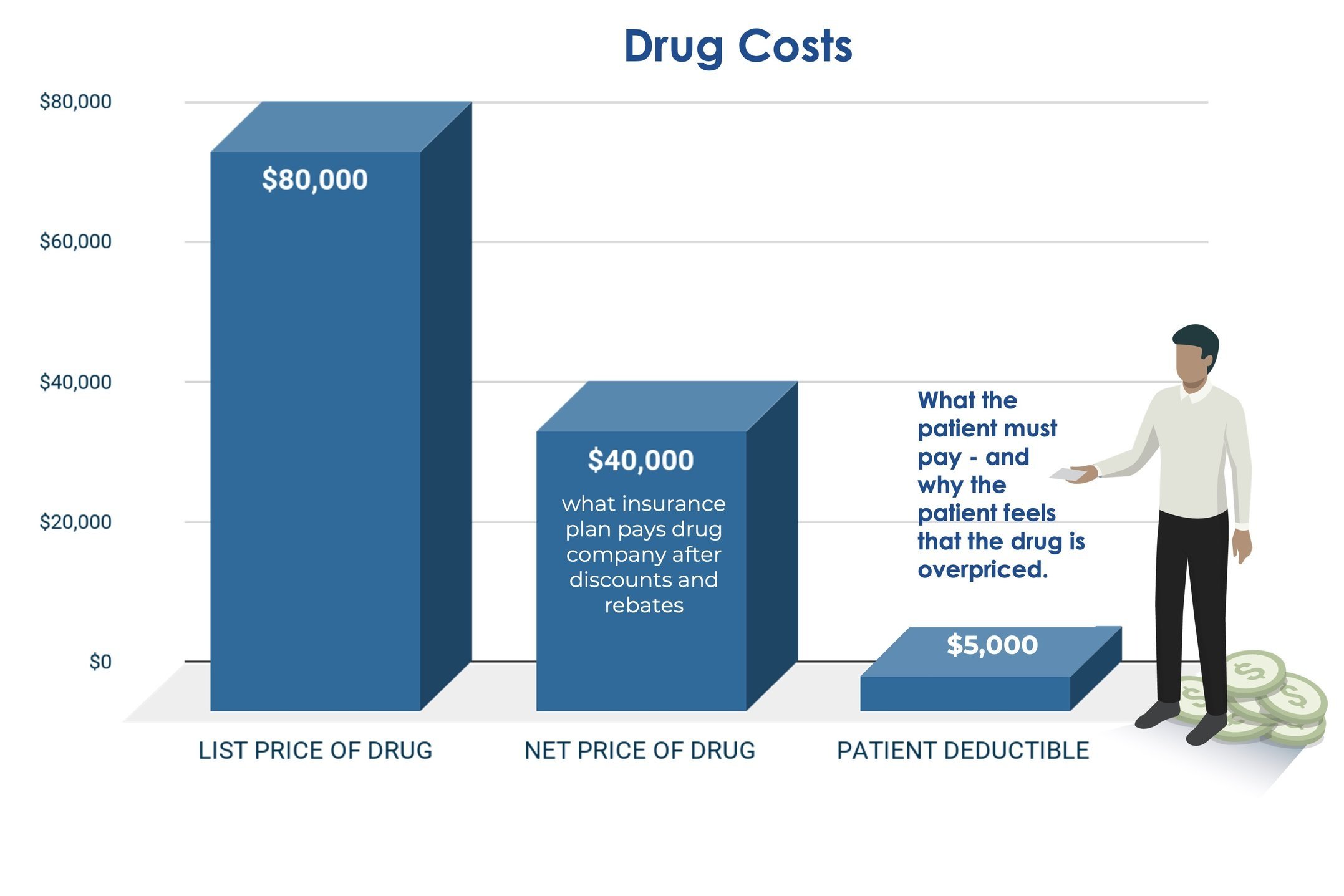

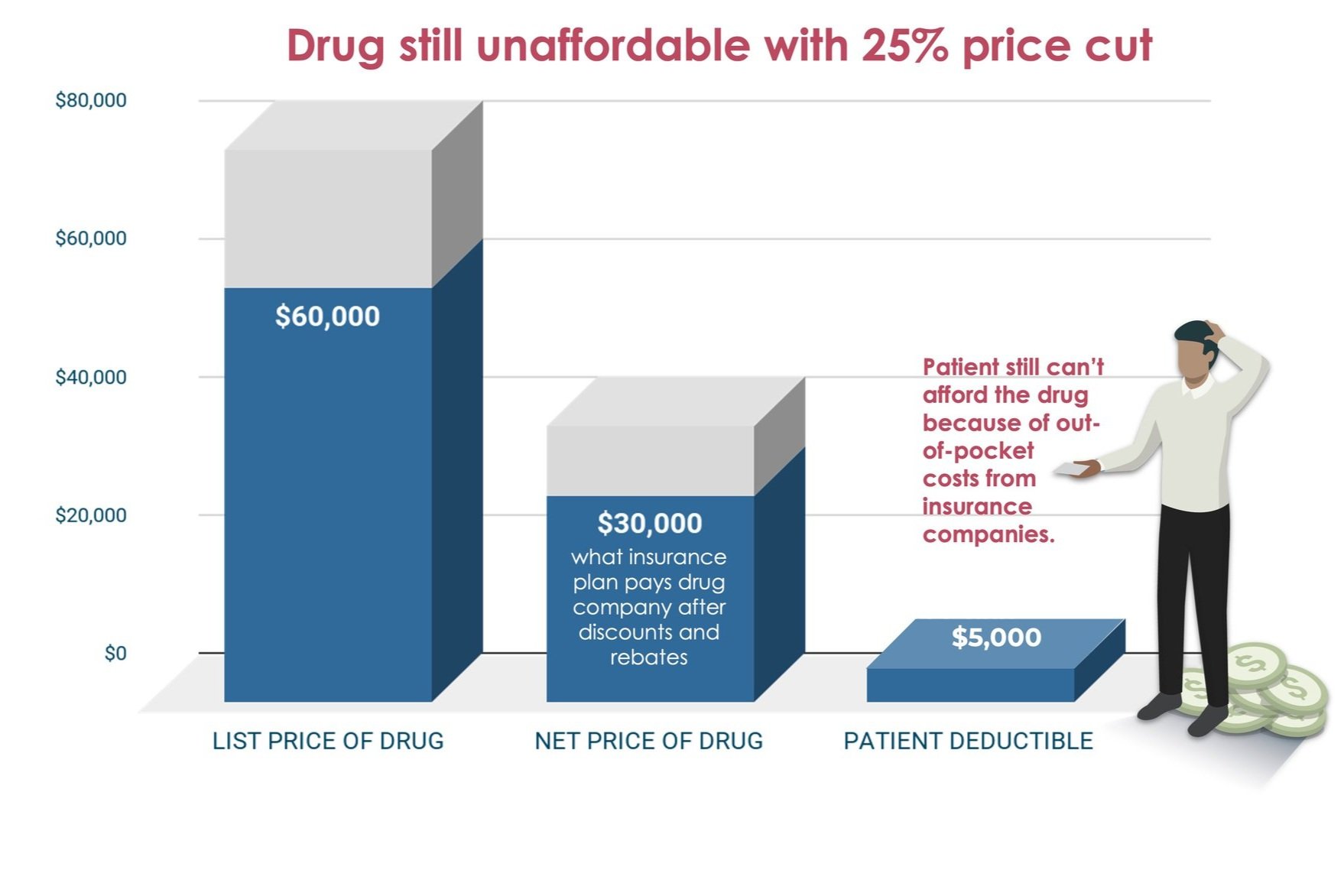

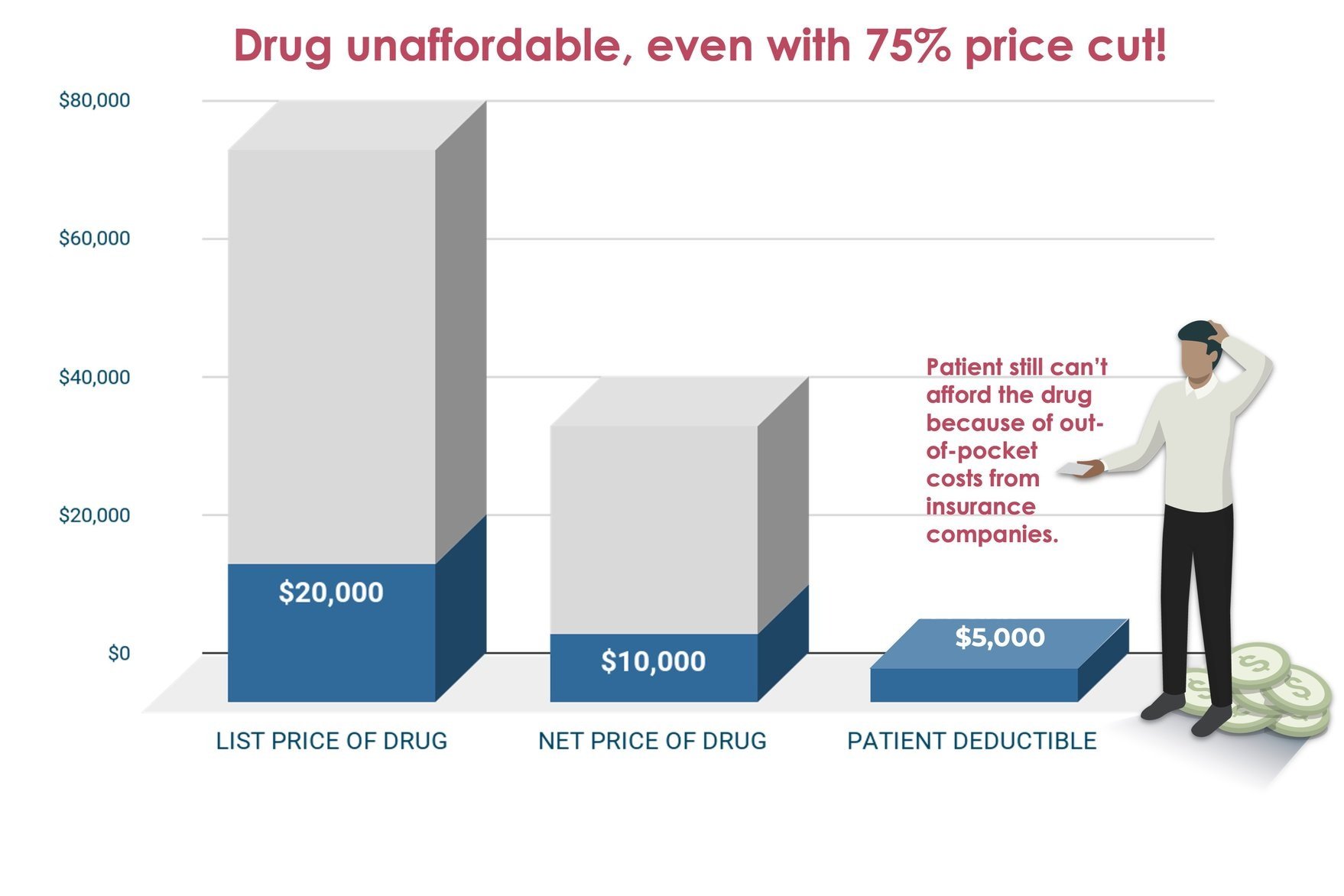

But even if you don’t care about any of that and think venture capitalists (and the retirees and pensioners who trusted VCs with their money) can invest elsewhere, cutting the list prices of drugs won’t help patients. We have to deal with high out-of-pocket costs at the pharmacy counter regardless of how drugs are priced.

Besides, drugs already come with their own built-in price controls. After a period of reward, they go generic, so their high prices are temporary, like a home mortgage. Consider statins. Lovastatin cost $3000/year when it came out (in 1980s money!), and now it costs less than $200/year. Like hundreds of other drugs, it was temporarily expensive, but competition eventually brought down the price and it continues to keep millions of people out of hospitals, preventing suffering and avoiding the expense of surgeries to treat heart attacks and strokes.

It’s obvious that price controls fail to solve affordability for patients. And by killing the innovation conversation, they also increase spending on healthcare in the long run, forcing us to utilize expensive hospital services instead of discovering new drugs. That’s like trying to save by not paying a mortgage on a home when your family is living in an increasingly expensive rented apartment.

Generic drugs save Americans billions of dollars every decade and always will. But the only way we create more generic drugs is by incentivizing the invention of new drugs with the temporarily high prices we pay for them while they are branded. Society’s signals to investors about what it’s likely to pay for new medicines in the future come from what society is willing to pay for new medicines today.

So what’s the bottom line?

What companies charge for drugs is not the problem Congress and the public think it is. It’s what insurers charge us at the pharmacy counter that hurts consumers’ wallets. And that will not go down as drug list prices go down.

The key to innovation is offering a high enough reward to both innovators and investors. Today’s prices encourage and support our current level of innovation. The key to getting value is ensuring that all drugs go generic without delay, so the prices of drugs that can’t or won’t go generic should be regulated once their patents expire to ensure society gets value for its investment in innovation. And the key to affordability is proper insurance, so high copays, deductibles, and other out-of-pocket costs should be eliminated or drastically lowered to make appropriate care affordable.

The drugs we pay for today incentivize us to invest in pursuing the development of the drugs that will rescue us and our children from devastating diseases tomorrow. We must inspire Congress to solve patient affordability without resorting to price controls on new drugs if we are to preserve the hope of better medicines and avert greater spending.

—

Interested in more like this? Check out the appendix to this module on RA University for the answers to additional questions, like:

Can society afford all this innovation? What’s the “right” amount to invest in new drugs?

What about the law of diminishing returns? Is the last billion dollars of innovation funding worth as much as earlier billions?

Shouldn’t productivity improvements mean we can get the same amount of innovation or more for less money?

Isn’t investing only in projects with higher probabilities of success (where prices could be lower) just smarter investing?

Even with price controls, what’s Pharma going to do if not invent drugs?

Why aren’t new antibiotics (which almost everyone agrees we need) investable projects today?

Can’t drug developers get around price controls with volume, by developing drugs that treat larger populations?

Please click here for important RA Capital disclosures.