The NIH, R&D, and the first mile of the marathon - a conversation with John LaMattina

By Rapport

August 11, 2022

Looking for an end-of-summer beach read? Former Pfizer R&D chief and current PureTech Health board member John LaMattina, PhD, has you covered.

John’s new book Pharma and Profits covers a range of biopharma topics, including pharma-payer dynamics, how we examine the value of drugs, the importance of genericization, and the Covid-19 pandemic. What really caught our eye is the chapter on federal investment in R&D and his artful description of the origin story of Xeljanz (tofacitinib), Pfizer’s oral JAK inhibitor for a variety of autoimmune indications.

This week we hopped on a Zoom with John and talked about the persistence of the misperception that NIH invents the drugs that biopharma companies sell, the chance encounters that can lead to breakthroughs years or even decades later, and the tough math facing investors and heads of research across the industry when deciding whether to invest in a project that’ll only enjoy nine years of market exclusivity. Our conversation has been condensed for clarity.

* * *

RApport: For years discoveries funded by the government really weren't being applied by the private sector innovation ecosystem. What changed?

John LaMattina: For over 100 years, the government invested in research, a lot of it for defense, but also in other technologies including health, which I would argue is what the government should be doing. That should be part of the government's job. Eventually they realized that we've got these early inventions and they're sitting on shelves, because the law at the time said that the government retained patent rights to anything that came out of the research that was funded by the NIH. So people just stayed away from that sort of research. And it wasn't until the Bayh-Dole Act came out in the 1980s, and then a little bit later, when a new head of the NIH came in, that things really loosened up and allowed companies to take non-exclusive licenses to these discoveries, with no kickback provisions.

Before he died, Bob Dole said that he was thrilled that work that was basically started at NIH and that was capitalized on by the biopharmaceutical industry was leading to the Covid vaccines. He said that Bayh-Dole boosted US economic output by $1.7 trillion, supported 5.9 million jobs, and led to more than 13,000 startup companies. So when people want to say ‘Well, what is the US citizen getting?’ How about that? Where else will America get that sort of pay off? It's unbelievable.

The technology in your iPhone is based on early government investments that led to its screens, memory, chips, etc. That's all government, initially, at a very early stage. Well, I can't walk into an Apple Store and say, ‘I want a new iPhone, I'm a citizen, and you're piggybacking off my tax dollars and so I want $100 off.’

John LaMattina

RApport: Why is it so hard to dislodge the popular belief that the NIH invents drugs and pharma companies swoop in late in the game to market them? This idea seems to persist even among people who ought to know better.

JL: I just don't think that even the people who ought to know better get it. What’s fascinating with the discovery of the mRNA vaccines is how people in this country were learning all about phase one, phase two, and phase three clinical trials. One would have thought that we would develop an appreciation for how difficult all this is.

But even today critics will argue that there really was no innovation by the biopharma industry with the mRNA vaccines and that all the key work was done by the NIH and academics. That these companies took no risk in going ahead and making the vaccines because Operation Warp Speed basically paid for it all. These people are at best naïve, and at worst lying. And that really drives me nuts.

What people don't appreciate is that yes, early research in mRNA vaccines was carried out by the NIH, but Moderna was in existence for a decade before we got to a point where we can actually make and deliver mRNA vaccines. The NIH didn't pay for much of that. It was venture capitalists who really invested in all that.

And then you take a company like Pfizer, which was working with BioNTech looking at mRNA vaccines for a new flu treatment. And when the pandemic hit, Pfizer went right to BioNTech and said, ‘We think we can do something here.’ They quickly did a handshake deal, agreed to a 50/50 split, and Pfizer then invests $2 billion in producing the vaccine. Bourla was a relatively new CEO. Imagine what would have happened to his career if this unproven technology led to nothing and Pfizer built all these factories to mass produce a vaccine that never worked.

RApport: How do we help people understand they’re getting value for their investment, even if biopharma companies are rewarded for developing drugs?

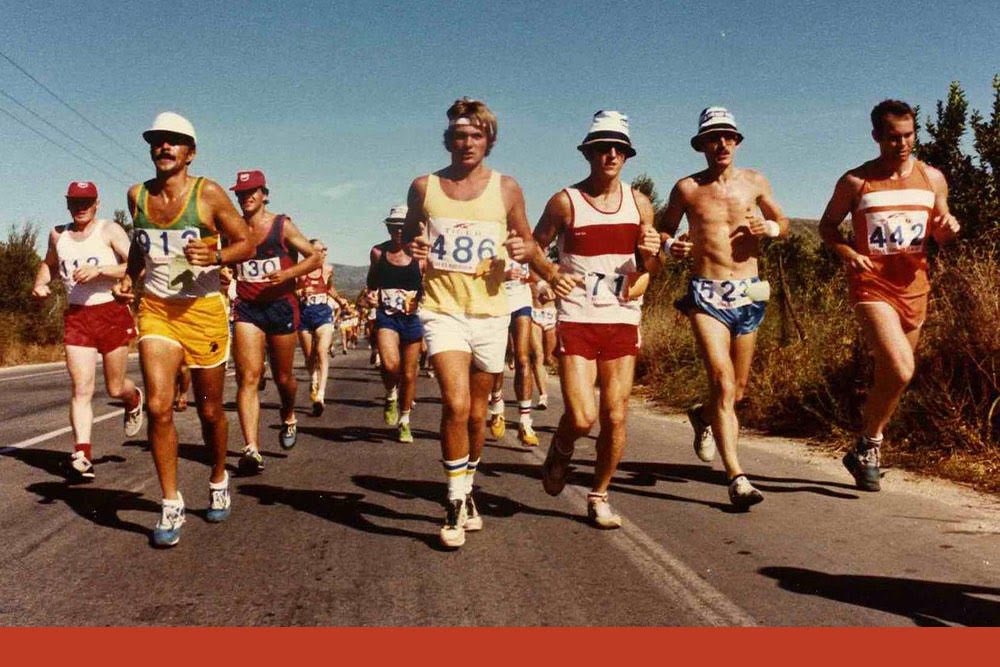

JL: You can't run 26.2 miles without running the first mile. Basic research that the NIH funds is important, and in fact, can be the first mile of the long R&D drug discovery process. But after the first mile, you've got more miles coming, each of which is harder and more draining and more consuming of one's personal resources … it gets harder and harder and harder. And people just don't understand this. People think that everything that comes out of the NIH is golden. They don't realize more than 95% of those ideas fail – it’s just the nature of early discovery research.

This is a basic principle that anyone who works in either biopharma or at the NIH understands.

RApport: You mention Xeljanz in the book as an example of a public-private partnership that resulted in a blockbuster. Tell me about the NIH work on JAK and how that led to the program at Pfizer.

JL: It's a great story. A Pfizer scientist, Paul Changelian, was getting ready to go to an immunology conference in Vermont. He was working on a project to develop a drug that would be better than existing treatments in preventing rejection of transplanted organs. So, not a huge market, but something of interest at Pfizer in the immunology area.

He almost didn’t go – his wife was seven and a half months pregnant. But she knew how important the conference was to him so she decided to go with him. If it came down to it, she’d have the baby in Vermont.

At the conference Paul runs into John O'Shea, a researcher at the NIH. O’Shea tells him about the work he’s doing on bubble boy syndrome, where kids are born without any immune system. O’Shea had discovered that they're missing a certain enzyme, called JAK.

Paul’s research was looking for ways to dampen down the immune system and realized that a drug that could block that same enzyme that's missing in people with bubble boy syndrome might be promising in patients with autoimmune diseases. So that initial NIH work and O’Shea’s insight were very valuable. First mile; 25.2 to go.

Now Paul was able to sign a non-exclusive license with NIH and get the reagents that O'Shea had so he can test compounds to see if they can actually block JAK, and that started the program. We got some profound results, eventually. But it took five years from that meeting to actually get to a potential drug candidate. We had about eight chemists and about four or five biologists working on it - that was a pretty standard program for us.

Once we had a drug candidate we got some terrific early results in monkeys through a collaboration with Stanford University, where the drug prevented kidney rejection. We then tested the drug in people with really severe psoriasis. We were clearing severe plaques in two weeks. We said “Holy cow, we have something.” And that led our clinicians to say, well, just maybe this will work in in rheumatoid arthritis, which would be even a bigger opportunity. So they went into rheumatoid arthritis, testing it in people who had failed Humira, and it worked wonderfully.

And so we went from bubble boy syndrome, to 14 years later, having a drug which we then took forward for rheumatoid arthritis, which could take the place of injections. And that was just the first JAK inhibitor. Twenty-five years since that meeting in Vermont, there are now six or seven other inhibitors specific to different immunological conditions based on work in different JAK receptors.

But this isn’t a unique example. It's a pretty common way for things to progress.

RApport: You end the book discussing drug pricing policy. We’ve obviously had a big development since then. Would the decision to go forward on something like Xeljanz that was going to take so long and cost so much money have been as straightforward with only nine years of exclusivity?

JL: That’s now the question everybody's going to have to ask. We just saw Congress pass a law without understanding the impact the law is going have on the drug discovery and development continuum. Small molecules are really the key for treating many diseases, easily go generic and are easy to take. As opposed to a biologic, where often you go into a hospital or a doctor's office to take it, maybe once or twice a month at a cost of maybe $2500 every time you get injected.

Now small molecule companies may no longer get a good return on their investment because they’ll only get nine years of life on these drugs. And any drug on the market does better and better each year that is out there such that it peaks usually right before it goes off patent. What were they thinking when they gave small molecules nine years [before Medicare price negotiation] and large molecules 13? It just makes no sense at all. Biologics are more difficult to go generic and the price doesn't drop as much. How did they not get this? This is absolutely stunning.

Take something where the clinical trials are going to be long and expensive, such as a new small molecule drug for heart disease. To get it on formularies and to get reasonable pricing you have to run a 10,000 patient, three- or four-year clinical study to show how your drug works against standard therapy, and prove that you're getting a difference in terms of preventing heart attacks and strokes. A very reasonable thing to do. A very reasonable thing for both payers and regulatory agencies to ask for. So now you're going to invest upwards of a couple of billion dollars … you may not make back much of your investment in such a case.

On the other hand, maybe you could invest in a biologic for a rare disease where you only have to test it in 200 patients, and you can get premium pricing out of it. Assuming there's nothing else out there for this disease. Really, am I going to pick the billion-dollar clinical program or the 200-patient clinical program? It's a no brainer what you’re going to invest in. On balance, we’re already going more and more to large molecules for pricing and longevity, and not facing patent loss as quickly. Now that will be exacerbated.

So as a research head, you have to think about that carefully. Particularly in an area like diabetes, obesity, or cardiovascular where clinical trials are pretty expensive. Or where there are multiple drugs in a class, where you've got other drugs that might be a couple of years ahead of you, where you have even less time to make your money if you're not the first one out there.

And that’s a shame, because the second or third drug has all sorts of benefits. The first drug doesn't work for everybody. There are people who need statins who can't take Lipitor, but Crestor works just fine. Plus, competition is what drives prices down! Look at what happened with the Hepatitis C drugs – a “thousand dollar pill” dropped to three hundred dollars or so when the competitors came to market. For certain diseases, this law might kill all that.

Please click here for important RA Capital disclosures.